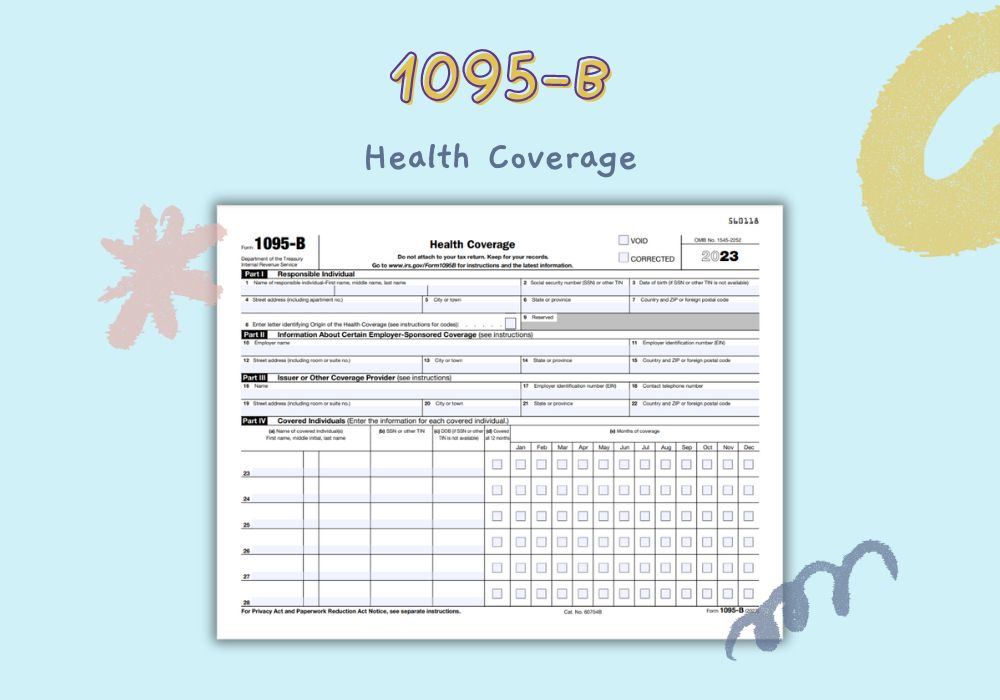

Printable 1095-B Tax Form

Blank IRS Form 1095-B for 2023 in PDF

Get FormAppropriate submission of tax forms is a vital part of a responsible citizen’s duty. For many, the task may appear both tedious and difficult, particularly when dealing with intricate forms like Form 1095-B. The goal here is to simplify every detail about the printable 1095-B tax form, making certain that you get a hold on the right way to handle it.

Federal Form 1095-B primarily reports details about your health coverage offered by insurance providers or employers. It’s an essential document for the Internal Revenue Service (IRS) to verify compliance with the Affordable Care Act (ACA), often referred to as Obamacare. It's crucial to properly fill this form out to avoid potential fines or penalties.

Layout of The Printable 1095-B Tax Form

The printable 1095-B tax form consists of five key parts:

- Part I: Showcases the spotlight on the recipient information and the policy issuer.

- Part II: Displays the employer's information if the coverage is employer-sponsored.

- Part III: Portrays the identifiers for the policy.

- Part IV: Enlists the names of everyone who is covered under the policy.

- Signature: This is the space where you approve the form’s accuracy by signing it.

Each segment must be precisely completed for a successful submission. One must ensure that the provided information aligns well with the tax returns for the same year.

Steps for the 1095-B Form Submitting

A well-structured, step-by-step guide makes processing the 1095-B form for 2023 printable an efficient task. Here's how to proceed:

- Begin by obtaining the latest printable Form 1095-B from the IRS website or your insurance provider.

- Fill out each part of the form accurately, ensuring no section is left incomplete or incorrect.

- After completion, review the entries for any potential errors or omissions.

- Upon satisfactory inspection, sign the form at the designated space.

- Submit the form according to the IRS instructions – mailed submissions or e-filing are both acceptable methods.

Meticulous rechecking and comprehensible organization of information will prevent avoidable errors, ensuring a smooth submission process.

Timeframe for Filing Form 1095-B

Time management is a key aspect of successful form submission. For the upcoming tax year, the IRS must receive your submission of the 1095-B form for 2023 printable on or before the announced deadline. The IRS generally sets the due date around early February following the tax year.

In essence, the responsibility of handling IRS-related documents like the 1095-B printable form might appear challenging at first. However, with accurate information, careful attention to detail, and maintaining an organized approach, it is feasible to make it an effortless process. Remember, understanding your tax duties is an essential step toward achieving financial literacy and independence.