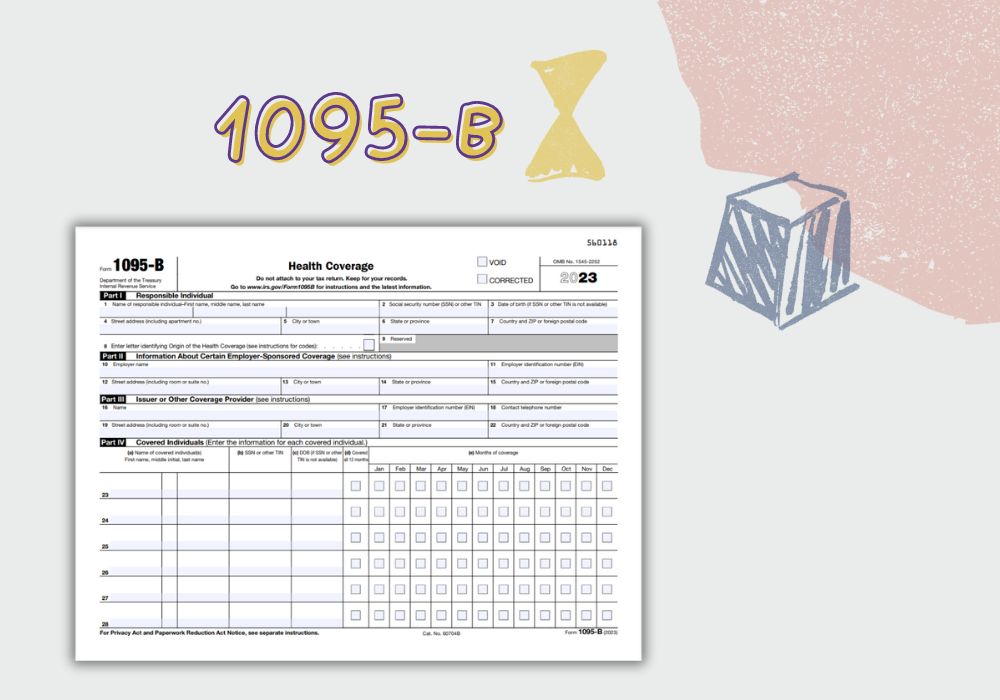

Form 1095-B Online

Blank IRS Form 1095-B for 2023 in PDF

Get FormNavigating the maze of tax-related paper tasks can often seem daunting. However, understanding the significance of each document, such as Form 1095-B, can be instrumental in simplifying the process. If you wish to get the 1095-B form online, you will first need to comprehend its purpose and relevance.

Form 1095-B, also known as the Health Coverage, is an Internal Revenue Service (IRS) tax document in the United States. It serves as a record of the health insurance coverage a person had during a specific year. Insurance companies, Medicaid, the military, or employers who provide health insurance but are not required to offer coverage under the Affordable Care Act are among the parties that issue Form 1095-B. This report allows the IRS to verify if an individual fulfilled the necessary health coverage requirements when they prepare their federal income tax return.

Recent Changes to IRS Tax Form 1095-B

The landscape of health insurance in the United States has substantially evolved in recent years. These changes increased in the IRS forms as well, including the 1095-B sample. Whilst still being an important document, the IRS, as of the tax year 2019, no longer requires Form 1095-B for filing your taxes. The document is, however, recommended to be retained for your records.

Eligibility for the 1095-B Tax Form

Understanding who can get 1095-B online is a critical aspect of the insurance process. If you had medical coverage for a year from an insurance company outside the healthcare marketplace, you will receive Form 1095-B. Similarly, if you were covered under a government program like Medicaid or Medicare or under your employer's health insurance plan (if they employ fewer than 50 full-time employees), you should expect to receive Form 1095-B as well.

Also, remember that you can obtain the 1095-B form online by following the link from our website.

Comparing the 1095 Forms

It's important not to confuse Form 1095-B with the similarly named documents. So before searching for Form 1095-B online, ensure you're eligible to use it. To clarify the distinction between these forms, consider this:

- Form 1095-A, also known as the Health Insurance Marketplace Statement, is provided by the marketplace to individuals who purchase medical coverage through them. It lists the details of the coverage and any premium tax credits received.

- As already outlined, Form 1095-B provides information about health insurance coverage provided by insurance companies, small employers, government programs, or other entities.

- Form 1095-C is provided by large employers (with 50 or more full-time employees) detailing the health insurance coverage offered to their employees.

Understanding the purpose and importance of Form 1095-B contributes to a clearer path toward completing your tax obligations. Make sure to get the 1095-B tax form online promptly to stay ahead of your finances and secure a hassle-free tax filing experience.